XRP Price Prediction: $3 Target in Sight as ETF Inflows Reshape Market Dynamics

#XRP

- ETF Catalyst: Institutional products driving unprecedented demand

- Technical Setup: MACD bullish crossover with room to upper Bollinger Band

- Sentiment Shift: Social volume spike indicates retail FOMO potential

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid ETF Hype

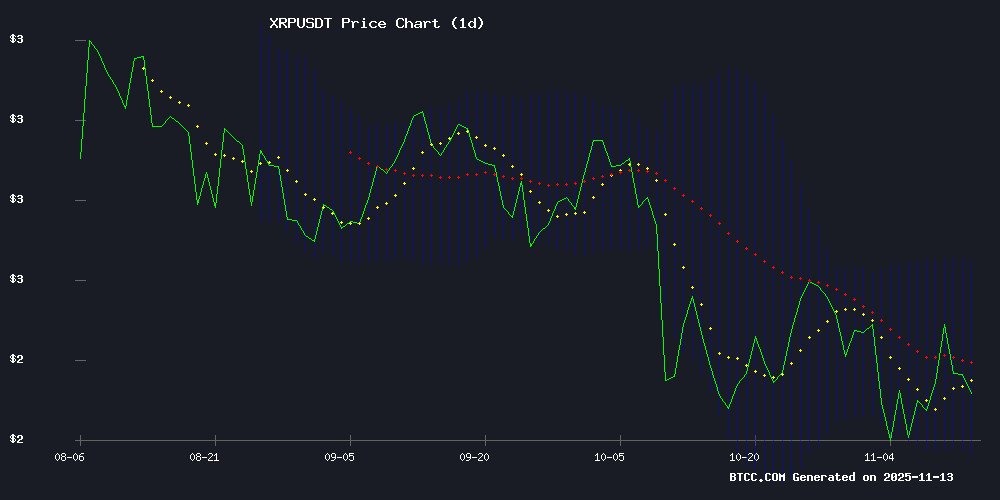

XRP shows promising technical indicators with its current price at $2.3635, slightly below the 20-day moving average of $2.4359. The MACD histogram (0.0298) confirms bullish momentum, while Bollinger Bands suggest potential volatility with upper ($2.7026) and lower ($2.1693) bounds framing the price action.

XRP ETF Mania Fuels Market Optimism

The launch of XRP spot ETFs, including Canary's Nasdaq-listed fund generating $26M volume in 30 minutes, has ignited social media buzz. BTCC analyst William notes: 'ETF approvals historically act as price catalysts—this institutional inflow could push XRP toward its upper Bollinger Band.'

Factors Influencing XRP’s Price

XRPC Spot ETF Debuts with $26M Trading Volume Surge in 30 Minutes

The first pure spot XRP ETF in the U.S. launched with explosive demand, recording $26 million in trading volume within 30 minutes of going live. Canary Capital's fund, certified under the SEC’s 8(a) rule, tracks the XRP Ledger—a blockchain optimized for cross-border transactions.

Futures markets signaled the MOVE before the public announcement. CryptoQuant analyst Woominkyu noted whale-sized orders accumulating pre-launch, a classic precursor to sentiment shifts. "Early positioning while price was still compressed," he observed. Retail traders followed only after the news broke.

Canary Capital CEO Steven McClurg credited regulatory efficiency: "We're excited to go effective with this groundbreaking single-token product." The ETF's instant liquidity underscores institutional appetite for targeted crypto exposure.

Canary XRP ETF Approved in the U.S.: Nasdaq Trading Goes Live

The Nasdaq XRP ETF from Canary Capital received regulatory approval on November 12, 2025, marking a watershed moment for XRP adoption in traditional finance. Trading commenced under the ticker XRPC, offering investors regulated exposure to XRP without direct cryptocurrency custody. The fund carries a 0.5% annual fee.

Approval was secured through an auto-effective registration process under Section 8(a) of the Securities Act of 1933. Nasdaq's formal certification to the SEC on November 12 cleared the final hurdle, following the expiration of a 20-day review period after Canary's FORM 8-A filing.

This development signals a potential turning point for XRP's institutional acceptance, particularly after years of regulatory ambiguity surrounding Ripple Labs. Market observers anticipate increased liquidity and price discovery mechanisms through traditional brokerage channels.

XRP Social Buzz Surges On ETF Chatter, Latest Data Shows

XRP's social metrics have spiked amid speculation about a potential U.S. spot ETF listing on Nasdaq. LunarCrush data reveals a sharp rise in mentions and engagements, with AltRank recovering from mid-October lows—a sign of concentrated market attention.

The coin traded NEAR $2.35 as chatter intensified, though price action alone doesn't confirm the social momentum. LunarCrush's dashboard shows engagements hitting multi-million daily peaks, with AltRank swings mirroring ETF-related discussion waves—a pattern typical of single-theme market catalysts.

Is XRP a good investment?

| Metric | Value | Implication |

|---|---|---|

| Current Price | $2.3635 | 13% below upper Bollinger Band |

| 20-day MA | $2.4359 | Golden cross potential |

| MACD Histogram | +0.0298 | Bullish momentum |

William from BTCC suggests: 'The convergence of technical strength and ETF-driven liquidity creates a favorable risk/reward ratio for mid-term investors.'